Firms in the construction and engineering industry deliver complex, high-value projects for exceedingly small profit margins. This creates major business risks, meaning that effective project financial control is essential if you are to keep your business on track. And with the global construction market predicted to grow by US $4.5 trillion to reach US $15.2 trillion by 2030, now is the time to get your project financial control up to date to keep profits high amidst rapid business growth.

Pair this rapid construction industry growth with the fact that we are now experiencing incredibly challenging economic times with increasing labor, material and supply chain costs, and it makes effective project financial control a must-have requirement. Yet, the surprising thing id that very few companies have implemented effective project financial control. In this blog, we discuss what is possible with world-class project financial performance and we give some pointers on how to improve the situation.

What does effective financial control look like?

The first thing most people think of is good accounting business practices and a modern accounting software solution. Yes, that is obviously important, but is it enough for Construction and Engineering companies to deliver predictable and repeatable project financial performance?

The simple answer is no. In this industry, the profit and cash drivers are projects. A company is a collection of projects, so if the projects make money and are in control, then the business makes money. So, this means effective financial control in a construction and engineering business is really about effective construction project management and project financial control.

What exactly is involved in having effective project financial control? You can think of each project as a business. So now, instead of focusing on the company, substitute the word company with the word project, and you edge closer to what effective project financial control should be managing.

- Project Margins and Profitability (Project P&L)

- Project Cash Management

- Project Risk Management

- Project Plan

- Project Budget Control

- Project Cost Monitoring

- Project Periodic Reviews and Accurate Outcome Forecasting

- Project Change Management

- Project Performance (on time, on budget, high quality, safely)

- Project Productivity

Accounting is an important part of the story, but accounting systems are primarily focused on measuring the past. In a project-based business, we need to forecast the future project outcome every month and produce as accurate a forecast as possible.

In short, it is more about Managing the Future not the Past.

Predicting project outcomes is critical, and having a predictable accurate project forecast is essential. Given the importance of this process, it is surprising that many companies manage it using Excel spreadsheets – a highly manual, time-consuming, and inaccurate process. It does not have to be this way!

See how one IFS customer, a major bridge construction company based in Poland, is using the IFS enterprise resource planning software to streamline business processes, centralize data, analyze all the stages of construction projects and manage the profitability of their projects.

What can you do to improve your project financial control process?

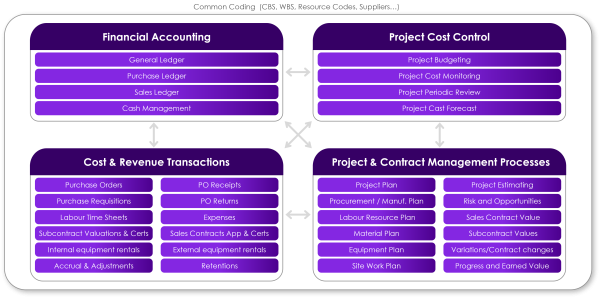

At IFS, we define effective construction project management and financial control as having an integrated approach to managing 4 key areas:

Accounting is essential, but if the other three areas are not managed with professional processes and modern business systems, like a cloud ERP system, you cannot achieve effective project financial control. Without that, your business will be put at risk.

The other challenge is that these are not four independent requirements – all four need to interact, be harmonious and integrated, and part of the same ERP system. Most companies are managing a substantial percentage of the scope in Excel spreadsheets, which has major risks. How do you know the information is accurate enough to make critical business decisions?

One IFS customer illustrates how its business growth led to multiple business systems and static spreadsheets being used in an attempt to manage project financial control holistically but how it was not suitable enough to keep pace with even its own internal reporting needs for upper management.

“By 2007 the company was relying on an amalgamation of legacy systems unable to communicate fully with each other. We had a litany of spreadsheets filled with duplicated, outdated or inaccessible data, the existing finance system was at the end of its lifecycle, and simple management reports were taking seven weeks to finalise, meaning we were always playing catch-up.” – Group Information Services Manager, Clancy Docwra

This one customer example showcases how the accounting system needs accurate actual cost and revenue transactions to feed it. These typically come from supplier invoices, purchase order receipts, sub-contract applications and valuations, equipment usage from internal or external rental charges, labor costs based on time and expenses. So, the accounting system should be fully integrated with all these cost & revenue transactions to ensure we have accurate and timely actual project costs.

Another real-world example of how an IFS customer is using its ERP software to track and improve project profitability is the case of NGE—a leading French construction company that supports the building and renovation of large infrastructures as well as urban projects. With the IFS ERP platform, NGE noticed that they were underutilizing site equipment, which negatively impacted their profitability. Their deputy chief executive officer explained,

“IFS’s {ERP software} allowed us to make this observation and then, by combining the information collected with the monitoring of worksites in the solution, to allocate resources and increase the time of use.”

Effective Project Cost Control is an essential part of the story. It relies on information from the three other areas, so if this information is inaccurate, outdated and incomplete, how can we expect to forecast the project’s outcome with any accuracy?

Today, we have the technology and cloud ERP systems to forecast the outcome of a project with minimum user interaction and a high degree of accuracy. Still, few companies have gotten close to this situation.

IFS has invested in the vision of having a completely integrated construction project management and project financial control solution for over 20 years and can now deliver this vision on a cloud ERP solution called IFS Cloud. This will allow your business to gain control and have repeatable and predictable project financial performance.

Having a fully integrated project financial control solution in place will result in the following key benefits:

- Improved Control and Governance

- Reduced Project and Business Risk

- More informed prompt decision making

- Improved Efficiency

- Improved Project Margins

To find out more, visit our webpage on project financial control and discover how Clancy Docwra – a leading national utility and construction company based in the UK, replaced Excel spreadsheets and an outdated financial system with the IFS cloud ERP system and increased job productivity, enhanced visibility, and measurable cost efficiency.

Do you have questions or comments?

We’d love to hear them so please leave us a message below.