Disclaimer by Author: I am hoping to discuss a general introduction to cryptocurrency, how they differ from ordinary currencies, their usage in businesses, transactions, ERP’s perspective, technical challenges, benefits, and drawbacks. This is not financial advice, and instructions for setting up cryptocurrency wallets and performing decentralized transactions is not within the scope of this article. Further, please do keep in mind that some cryptocurrencies tend to be significantly volatile. Always take expert financial advice and invest in cryptocurrency which you can afford to lose!

On the Halloween of October 2008, an anonymous person or a team called “Satoshi Nakamoto” released a white paper for the “Bitcoin” protocol and subsequently released its open-source software on 9th January 2009. It was marked as a watershed moment in the history of financials and economics as it resulted in rapid explosion of De-Centralized Finance. This allowed individuals, businesses, and enterprises to carry out financial transactions without going through a third-party financial institution. The identity of “Satoshi Nakamoto” remains mysterious to-date.

As much as it provided hope for decentralized finance, it wasn’t without any drawbacks especially due to extremely volatile nature of Bitcoin. Nevertheless, Bitcoin opened a new era and allowed many other cryptocurrencies to be emerged including stable coins which are not volatile.

Before we discuss the hype of cryptocurrency such as Bitcoin, let’s first distinguish between ordinary fiat currency and cryptocurrency.

Defining our familiar currencies

An ordinary fiat currency is any currency system that is part of Centralized Finance. This implies that a particular currency is controlled by a single authoritative entity.

For example,

- Sri Lankan Rupee (LKR) – Controlled by Central Bank of Sri Lanka

- Swedish Krona (SEK) – Controlled by Sveriges Riksbank in Sweden

- British Pound Sterling (GBP) – Controlled by Bank of England

- United States Dollar (USD) – Controlled by The Federal Reserve in United States of America

As you can see, every currency in centralized finance has a controlling body for the management of a particular currency. But when it comes to cryptocurrencies such as Bitcoin, they typically fall under De-Centralized Finance (DeFI). Unlike centralized finance, DeFI don’t have governing bodies such as central banks.

While there is a wide variety of DeFI projects and cryptocurrencies, let’s focus on Bitcoin for the moment for the sake of simplicity.

What is Bitcoin made of?

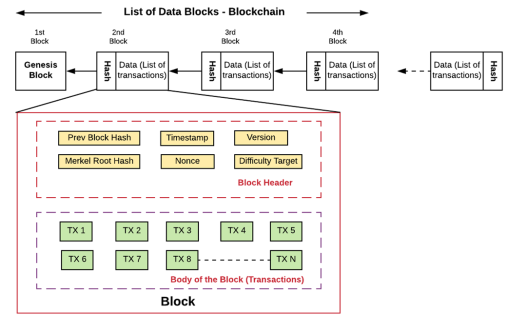

While an ordinary fiat currency is created and managed by a central authority, in contrast, cryptocurrencies such as Bitcoin are made entirely with an emerging technology called “Blockchain”. It is a data structure which contains an ordered list with each item in the list is linked with hashes and is secured by cryptography.

Image Courtesy: https://vitalflux.com/blockchain-linked-list-like-data-structure/

In such a data structure, the Genesis Block is the starting point of a particular blockchain. Linked to it sequentially is the list of blocks which relate to hashes. Hence, blocks are chained together in a list, so we call it Blockchain. Due to the hashing mechanisms which chain these blocks, it is impossible to tamper the data in the middle without modifying the rest of the blockchain. This allows the public ledger to be secure and free from unauthorized modifications. Therefore, Bitcoin is a distributed public ledger that is secure. It is also impossible to tamper without hijacking majority of the network power available in the blockchain network.

Let’s do a simple comparison between ordinary fiat currency and cryptocurrency transactions.

A normal fiat currency transaction among banks

A simplest case we can think of is a fund transfer taking place between 2 bank accounts. We know that for such transactions, we need the below 2 key information:

Receiver’s Bank Name/Branch.

Receiver’s Bank Account Number.

Additionally, when it comes to international transactions, we may have to use SWIFT code to uniquely identify banks worldwide. Notice that, any of those transactions are legally tied to a person or a business entity because the Account number is tied to them.

In contrast, for Bitcoin transactions, we will need only the below for sending the funds.

* Bitcoin Address (Eg: 1CPcMw2HURe4kWj6UHukpaQB4avqpedqhC)

That’s simple as it is! Even if you have to send funds to someone outside of your country or to someone from Mars (if Elon Musk builds a Martian colony J), you just have to send bitcoin funds to a Bitcoin address which looks like above!

To visualize, imagine the Bitcoin Address as the postal address of your house. You can give out your address to others and they can send money to your address’s location. Then, from the receiver’s perspective, you will have your Private Key to your house. This means that only you can access the funds received to the address.

So, here’s the private key of the Bitcoin belonging to the above address: L4C2bFxW4KqbXeBmWV6QQ95yHkyyGsHHpk5nT4UHwWUBrh4384wQ

The private key is just like a password. Anyone who has that Private Key will have access to the funds received to the Bitcoin Address mentioned earlier. You can visualize it as sharing the Private Key to your house among your family members. You either get to keep the Private Key for yourself, or you are free to share it.

The funds received exist in the digital space in a distributed public ledger secured by cryptography. (Notice that I have shared a real private key above, but it does NOT have funds J)

When a sender initiates a “Send transaction”, they don’t go through a third-party financial institution such as a bank. Instead, they are processed through peer-to-peer network, which is distributed globally, and hence the name de-centralized. When it comes to transaction speed, it will depend on factors like network load and transaction complexity. Yet, it is widely regarded that blockchain transaction speeds continue to dominate over the bank transfer speeds especially for cross boarder payments.

Keep in mind; Transactions are Irreversible!

Any DeFi transaction that is performed in a block chain network is practically irreversible. Notice that it could be considered both a problem and a feature depending on business requirements. It could be a problem because you cannot reverse an accidental transaction. Whereas, it can be a feature because a malicious hacker cannot reverse it!

In contrast, when transactions occur via third parties in centralized finance (such as when you are making a payment at Supermarket using the Credit Card or performing a bank transfer), it is possible to reverse the transactions later with the intervention of the centralized third party. This is crucial when it comes to dealing with fraudulent transactions to recover any unauthorized use of funds. For instance, in the case of a fraudulent transaction occurring against your credit card, you can lodge a formal complaint with your card issuer. After the card issuer/bank carries out the necessary investigations pertaining to your complaint, they will be able to reverse the transactions or provide you with refund if they find the evidence supporting for your case.

But when it comes to cryptocurrency, there is no central party involvement. For a transaction reversal to take place, receiver of the funds must explicitly initiate a SEND transaction to return the funds back to the person who initially sent it!

A note about Volatility

Another concern in cryptocurrencies is its high volatility. While exchange rates generally differ for fiat currencies every day, the exchange rates for cryptocurrencies can differ every hour (and even every second in highly volatile situations!). To make things worse, the rate of change can also be much larger than fiat currencies!

The following is a notable example of such an intense volatility. On August 28, 2019, the price of Bitcoin plunged more than 5% within a span of minutes!

Image Courtesy: https://www.ccn.com/bitcoin-price-crash-7-percent-minutes/

An ERP’s perspective

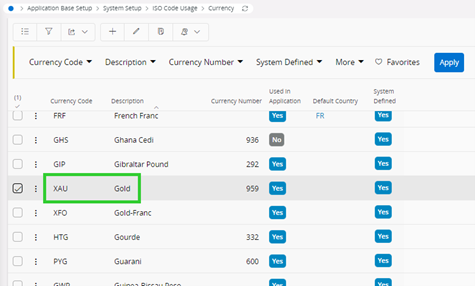

As per the industry standards, ERPs generally support all fiat currencies. For example, the latest IFS Applications Cloud comes with a whopping 230 amount of pre-defined set of currency codes that even includes some non-fiat currencies. For instance, you can also choose Gold by selecting “XAU” as the currency code (XAU is the internationally accepted currency code for gold). The importance of having Gold defined here will help us transcend to our next milestone!

Image Courtesy: IFS Cloud 22R1

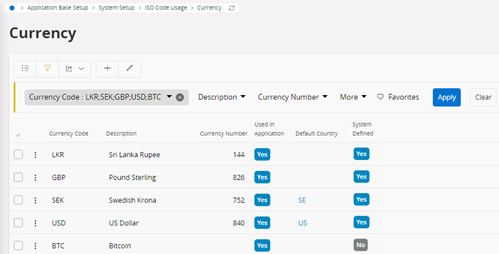

Now, apart from those system defined currencies; you have the freedom to define your own custom currencies. So, here is an example where I try to define the cryptocurrency Bitcoin in the IFS Cloud.

Image Courtesy: IFS Cloud 22R1

Viola, it wasn’t that difficult, was it? Eh, not so fast! There are few problems here. First, defining Bitcoin as an ordinary currency does not tally with International Accounting Standard (IAS) No. 7 which “establishes standards for cash flow reporting used in International Financial Reporting Standards”. But here’s the catch; some critics argue that Bitcoin could be considered as digital gold. Since Gold is already pre-defined in the system even when it isn’t supported by IAS7 definition, you may wonder if we can define Bitcoin the same way disregarding IAS 7. Sure, you can. But it’s a bit complicated than gold. As for the transactions, while you will still have to perform transactions through your Private Bitcoin Wallet containing the Private Key, Bitcoin explicitly uses 8 decimal places. Therefore, you may want to shift the decimal point by several levels should you want to test this. But of course, nothing will prevent you from playing around by defining any currency you want together with its related basic data setup for testing!

There are also other important considerations that you want to make prior deciding to do transactions with cryptocurrency. Things like taxations play a key role in currency transactions. Even though cryptocurrencies do not have a legal controlling authority, the law can still enforce taxes. Therefore, the tax functionality in an ERP should not necessarily stay dormant for cryptocurrency transactions. Nevertheless, the behavior may have to be altered to incorporate varying tax laws for cryptocurrency.

If the system is used only for recording the transactions and the Finance department takes in charge for performing the transactions via their private cryptocurrency wallets, the processing within the application is much straightforward as it only involves in record keeping. The tallying and balancing part will be done by the Finance department.

Is cryptocurrency accepted everywhere?

The answer is an easy NO! Although the future looks promising, there are some obstacles that lie ahead. As far as accounting standards are concerned, I have mentioned above that the cryptocurrencies such as Bitcoin do not tally with IAS 7. This is an important identifier for accepted currencies. Hence, a heated debate is out there on the acceptance of cryptocurrency as there are no established accounting standards recognized by majority for cryptocurrency transactions. To make things worse, as of now only few governments are accepting cryptocurrencies as legal tender. Even though Bitcoin is considered by some as a form of digital gold, Bitcoin’s legal approval is far less than the physical gold. Hence, due to extreme price volatility and lack of legal tender among governments, cryptocurrencies do not tally only with IAS 7 but also with several other standards set by The International Financial Reporting Standards (IFRS) Foundation.

Further, cryptocurrency has also been criticized for being a tool for money laundering. However, the supporters for cryptocurrency argue that money laundering has been happening way before the emergence of cryptocurrency. It is also not an inherent characteristic for cryptocurrency alone.

Even with such an ongoing debate on various issues and with the lack of acceptance and approval by majority of the legal frameworks, there is a path to rescue for cryptocurrency by IAS itself, specifically IAS 38. It is possible to define cryptocurrency by IAS 38 as intangible assets; “an identifiable non-monetary asset without physical substance”. You’re Welcome!

Closing Notes

While the jury is out there on acceptability of cryptocurrency worldwide, there is a huge division in the business world on its reception. Nevertheless, it has been noted that various businesses have already begun performing cryptocurrency transactions. While some business entities may initially find it difficult to consider it as a pure currency, it would still be possible to consider cryptocurrency as intangible assets thanks to IAS 38 definition. Even still, it is crucial to keep an eye on the risks associated with cryptocurrency. This is especially important due to its high volatility, and to perform adequate risk assessments prior to considering cryptocurrency as a mean of investment or a transaction currency.

Interested in working with latest technologies?

Join IFS: Careers | IFS

References

- International Financial Reporting Standards (IFRS) courtesy of IFRS Foundation

- International Accounting Standards (IAS) analysis on cryptocurrency courtesy of ACCA and PwC

Do you have questions or comments?

We’d love to hear them so please leave us a message below.