At the end of 2015, IFS carried out a global survey of over 1,000 IT decision makers from companies in 12 countries. The survey aimed to gather insight on the subject of change in businesses: its relevance, impact and drivers. The results revealed a number of interesting trends across different vertical industries and here, Antony Bourne gives his thoughts on those relating to the manufacturing industry.

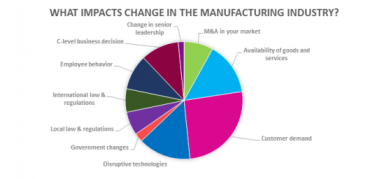

This infographic depicts a full summary of the results.

Today more than ever, companies are realizing that if they don’t change, they will become the next casualty of the manufacturing race. This means that, theoretically at least, most manufacturing businesses are open to change.

In a recent survey that IFS undertook, those working in the manufacturing industry highlight “changes in availability of goods and services” as something they consider one of the most influential factors for change in their business (selected 41% of the time). This isn’t hugely surprising, given the rising levels of consumerism in today’s society, with consumers demanding their products faster and faster and pressure being applied in a variety of different ways. This is where technology such as 3D printing can help.

By cutting down some of the current processes, for example in the aerospace industry where companies are starting to create partition walls in the aircraft with 3D printers. The printer is able to create a wall that is just as strong but uses far less material, making the process far more cost-effective. Demand planning can also help with addressing the issue of ever-changing availability of goods and services. Deploying an effective demand planning strategy can help organizations to continue to run as usual through periods of not only fluctuating demand, but also fluctuating supply of products.

Another element of our survey saw manufacturers recognizing the impact of disruptive technologies as a change factor affecting their business (selected 41% of the time). Disruptive technologies, many of which are included in the bracket of Industry 4.0 (a German vision for manufacturing based around smart factories), are being used by companies to differentiate themselves in an ever more competitive market. There is a flip side to this however, with 43% of manufacturers recently saying that the biggest obstacle in leveraging the Internet of Things (a key part of Industry 4.0) is a lack of understanding around how it can help their business. This demonstrates that there is still a certain level of education to be done in the space to ensure manufacturers are taking advantage of all the new technologies available to them.

Regional Results

When we broke our survey findings out by region, it was interesting to see that Germany and China both deem these disruptive technologies very influential on their businesses (with German respondents selecting it 44% of the time and Chinese respondents 42% of the time). These two countries are considered as two of the main players in the global manufacturing industry and therefore need to maintain their uniqueness; something that’s made easier by embracing new technology that can revolutionize processes traditionally slowed down by legacy infrastructure.

Despite Germany and China being the current drivers, every single economy is focused on growth. At a recent conference, I carried out a quick poll of our manufacturing customers and 80% were forecasting for business growth in 2016, which is hugely positive. One way I’m seeing growth being driven is through servitization. More and more of our manufacturing customers are looking to servitization as a way to boost revenue, increase margins and lock-in customers. In the same poll, 70% of those customers were already offering extra services after the sale of their product.

Factors Attacking the Status Quo

We are currently in the advent of a fundamental change in the way that manufacturers are doing business, with several factors essentially ‘attacking’ the status quo. New technology, shifts in global markets (for example the weakening of manufacturing in China) and changing attitudes are impacting businesses as they look to the future of the manufacturing sector. Up and coming countries, such as those in Eastern Europe, are vying for European market share with their governments giving grants to build new factories that will, by the virtue of being new, include smarter technology. The next few years will be exciting for manufacturing and I’m looking forward to seeing how both our customers and their customers embrace this change and move into the future of manufacturing.

You May Also Be Interested In…

RETAIL INDUSTRY — A CHANGE WOULD DO YOU GOOD

After reviewing the results of IFS’s global survey, Ulf Tillander gives his thoughts on changes in the retail industry, their relevance, impact and drivers. Read Blog >

Sendhamarai Engineering

Lovely list. This information is really very helpful. Thanks for the sharing.

Slitting Rewinding

You have written a very good blog, it is very knowledgeable. Same issues in our state on business of Slitter Rewinder Machine

RobbieRoyce

Wow, Great information and this is very useful for us.

Aluminium scaffolding hire

savanah

thanks for your valuable information Keep going..

Aluminium scaffolding manufacturer in chennai

RoyceRobbie

Wow Good information and this is very useful for us, keep sharing like this

Crm Software Development Company in Chennai

savanah

Apple Infoway Provides Cheap Domain Registration & Web Hosting Services in India @999/- INR Yr. For Domain Registration & Web Hosting Server. Call +91 -93800 37777

cheap web hosting company chennai

jasikajessy

Thanks for this valuable information sharing, and i learned a lot and cleared my all doubts in this.. keep posting like this useful information.

Scaffolding Dealers in Chennai

jasikajessy

Thanks for this valuable information sharing, and i learned a lot and cleared my all doubts in this…

Scaffolding Dealers in Chennai